Please allow us to collect data about how you use our website. We will use it to improve our website, make your browsing experience and our business decisions better. Learn more Learn More

In a surprising announcement on Sunday, March 2, U.S. President Donald Trump revealed plans to create a strategic reserve of cryptocurrencies, sending shockwaves through the digital asset market. The announcement, made on his social media platform Truth Social, named five cryptocurrencies that would form the backbone of this reserve: bitcoin (BTC), ether (ETH), XRP, solana (SOL), and cardano (ADA). The news immediately sparked a surge in the market value of these assets, with the total cryptocurrency market capitalization rising by over $300 billion in just a few hours, according to CoinGecko.

This move marks a significant shift in the U.S. government’s approach to digital assets, signaling a potential embrace of the crypto economy under the Trump administration. Let’s break down what this means for the crypto industry, the market, and the broader financial landscape.

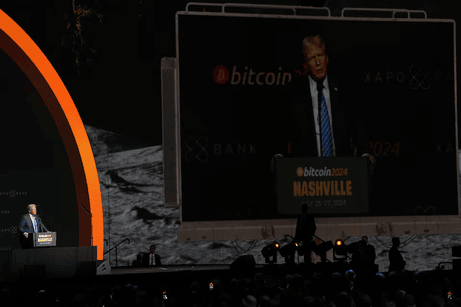

The Announcement: A Game-Changer for Crypto

Trump’s post on Truth Social outlined his vision for a U.S. strategic reserve of cryptocurrencies, a concept that had not been previously disclosed. He specifically named bitcoin, ether, XRP, solana, and cardano as the core assets to be included. In a follow-up post, he emphasized that bitcoin and ether would be “at the heart of the Reserve,” underscoring their importance in the broader digital asset ecosystem.

The announcement had an immediate impact on the market:

Bitcoin surged over 11% to $94,164.

Ether jumped 13% to $2,516.

XRP, solana, and cardano also saw significant gains, reflecting investor optimism about their inclusion in the reserve.

This move is part of Trump’s broader pro-crypto agenda, which has already included hosting the first White House Crypto Summit and scaling back regulatory scrutiny of the industry.

Why This Matters: A Shift in U.S. Crypto Policy

Trump’s announcement represents a stark departure from the regulatory crackdowns seen under his Democratic predecessor, Joe Biden. The Biden administration had taken a more cautious approach, focusing on protecting Americans from fraud and money laundering in the crypto space. In contrast, Trump’s administration has rolled back investigations into crypto companies and dropped a high-profile lawsuit against Coinbase, the largest U.S. cryptocurrency exchange.

The creation of a cryptocurrency reserve signals a more proactive stance by the U.S. government, potentially accelerating institutional adoption and providing much-needed regulatory clarity. As Federico Brokate, head of U.S. business at digital assets investment firm 21Shares, noted:

This move signals a shift toward active participation in the crypto economy by the U.S. government. It has the potential to accelerate institutional adoption, provide greater regulatory clarity, and strengthen the U.S.’s leadership in digital asset innovation.”

Market Reactions and Analyst Insights

The market’s response to Trump’s announcement was overwhelmingly positive, with the total cryptocurrency market capitalization rising by 10% in a matter of hours. However, some analysts expressed surprise at the inclusion of assets like XRP, solana, and cardano, which are often viewed as more speculative compared to bitcoin and ether.

James Butterfill, head of research at asset manager CoinShares, commented:

“Unlike bitcoin...these assets are more akin to tech investments. The announcement suggests a more patriotic stance toward the broader crypto technology space, with little regard for the fundamental qualities of these assets.”

Despite the initial excitement, the market’s long-term trajectory will depend on broader economic factors, such as the Federal Reserve’s interest rate policies, and the Trump administration’s ability to deliver on its promises.

The Bigger Picture: A Strategic Reserve for the Future

The idea of a U.S. cryptocurrency reserve raises important questions about how it will be established and managed. Some experts argue that congressional action may be required to create such a reserve, while others believe it could be done through the U.S. Treasury’s Exchange Stabilization Fund, which has the authority to buy and sell foreign currencies.

Trump’s crypto group has also explored the possibility of using cryptocurrencies seized during law enforcement actions to build the reserve. This approach could provide a unique way to integrate digital assets into the U.S. financial system while addressing concerns about illicit activities.

What’s Next for Crypto Under Trump?

Trump’s pro-crypto stance has already reshaped the regulatory landscape, but the industry’s future remains uncertain. While the announcement of a strategic reserve has injected optimism into the market, challenges remain. Cryptocurrency prices have been volatile in recent weeks, with some assets erasing nearly all the gains made after Trump’s election victory.

Analysts suggest that the market needs additional catalysts to sustain its upward momentum, such as:

Interest rate cuts by the Federal Reserve

A clear, pro-crypto regulatory framework

Increased institutional adoption

Notably, Standard Chartered analyst Geoff Kendrick has projected that bitcoin could reach $500,000 before Trump leaves office, a bold prediction that underscores the potential for significant growth in the crypto market.

Conclusion: A New Era for Crypto?

Trump’s announcement of a U.S. strategic reserve of cryptocurrencies is a landmark moment for the industry. It reflects a growing recognition of digital assets as a legitimate and valuable part of the global financial system. While the market’s immediate reaction has been positive, the long-term impact will depend on how the reserve is implemented and whether the Trump administration can deliver on its ambitious promises.

For now, one thing is clear: the U.S. government’s approach to crypto is changing, and the implications could be far-reaching for investors, institutions, and the broader economy. As the first White House Crypto Summit approaches, all eyes will be on Trump and his team to see how they navigate this new frontier.

What do you think about Trump’s crypto reserve plan? Share your thoughts in the comments below!